The 15-Second Trick For Estate Planning Attorney

The 15-Second Trick For Estate Planning Attorney

Blog Article

Estate Planning Attorney - Questions

Table of ContentsGetting The Estate Planning Attorney To WorkThe 15-Second Trick For Estate Planning AttorneyThe 25-Second Trick For Estate Planning AttorneySome Known Factual Statements About Estate Planning Attorney

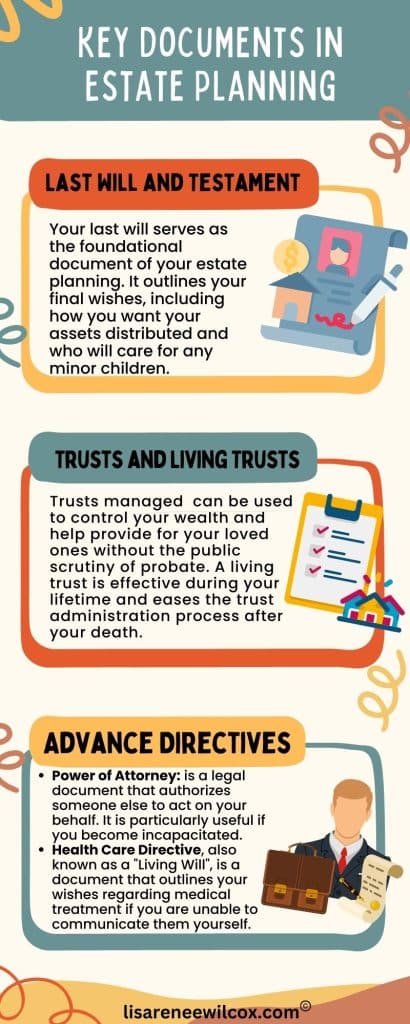

Estate planning is an action plan you can use to determine what happens to your assets and responsibilities while you're to life and after you pass away. A will, on the other hand, is a legal file that describes exactly how possessions are dispersed, that deals with kids and family pets, and any type of other dreams after you die.

The administrator also has to repay any taxes and financial obligation owed by the deceased from the estate. Creditors typically have a minimal quantity of time from the date they were notified of the testator's death to make insurance claims versus the estate for cash owed to them. Claims that are turned down by the administrator can be brought to justice where a probate judge will have the last word regarding whether the case is valid.

8 Simple Techniques For Estate Planning Attorney

After the supply of the estate has actually been taken, the value of possessions computed, and taxes and financial obligation settled, the executor will after that look for consent from the court to disperse whatever is left of the estate to the beneficiaries. Any estate taxes that are pending will certainly come due within 9 months of the day of fatality.

Each private locations their possessions in the depend on and names a person various other than their partner as the beneficiary. A-B depends on have become much less preferred as the estate tax exemption works well for many estates. Grandparents may transfer assets to an entity, such as a 529 strategy, to sustain grandchildrens' education and learning.

The Best Guide To Estate Planning Attorney

Estate coordinators can collaborate with the benefactor in order to decrease gross income as a result of those contributions or create methods that make best use of the impact of those contributions. This is one more strategy that can be utilized to restrict death tax obligations. It involves a private securing the present worth, and thus tax obligation liability, of their property, while associating the worth of future growth of that capital to an additional person. This technique entails freezing the value of a property at its worth on the date of transfer. Appropriately, the quantity of potential funding gain at fatality is additionally frozen, enabling the estate organizer to estimate their prospective tax obligation responsibility upon death and better prepare for the repayment of income taxes.

If adequate insurance policy proceeds are offered and the plans are effectively structured, any earnings tax obligation on the regarded personalities of properties following the death of an individual can be paid without turning to the sale of possessions. Profits from life insurance that are received by the beneficiaries upon the death of the insured are generally revenue tax-free.

Various other costs connected with estate preparation consist of the prep work of a will, which can be as reduced as a couple of hundred bucks if you utilize one of the finest online will makers. There are specific files you'll need as part of the estate planning process - Estate Planning Attorney. A few of the find out here most common ones include wills, powers of lawyer (POAs), guardianship classifications, and living wills.

There is a misconception that estate preparation is just for high-net-worth people. That's not true. Actually, estate preparation is Look At This a device that every person can utilize. Estate intending makes it less complicated for people to identify their wishes before and after they pass away. In contrast to what lots of people believe, it expands past what to do with possessions and obligations.

The Best Guide To Estate Planning Attorney

You should begin planning for your estate as soon as you have any kind of measurable possession base. It's an ongoing process: as life proceeds, your estate strategy must change to match your situations, in accordance with your new goals. And maintain it. Not doing your estate preparation can cause unnecessary economic concerns to liked ones.

Estate preparation is often believed of as a device for the well-off. That isn't the instance. It can be a useful way for you to take care of your properties and liabilities before and after you die. Estate planning is likewise a wonderful way for you to lay out plans for the care of your minor kids and family go to my site pets and to outline your long for your funeral service and favorite charities.

Applications need to be. Qualified applicants who pass the exam will certainly be formally certified in August. If you're qualified to rest for the exam from a previous application, you may file the brief application. According to the rules, no qualification shall last for a duration much longer than 5 years. Figure out when your recertification application is due.

Report this page